Empowering Youth with Financial Literacy

Money Smart Summer Cohort 2025

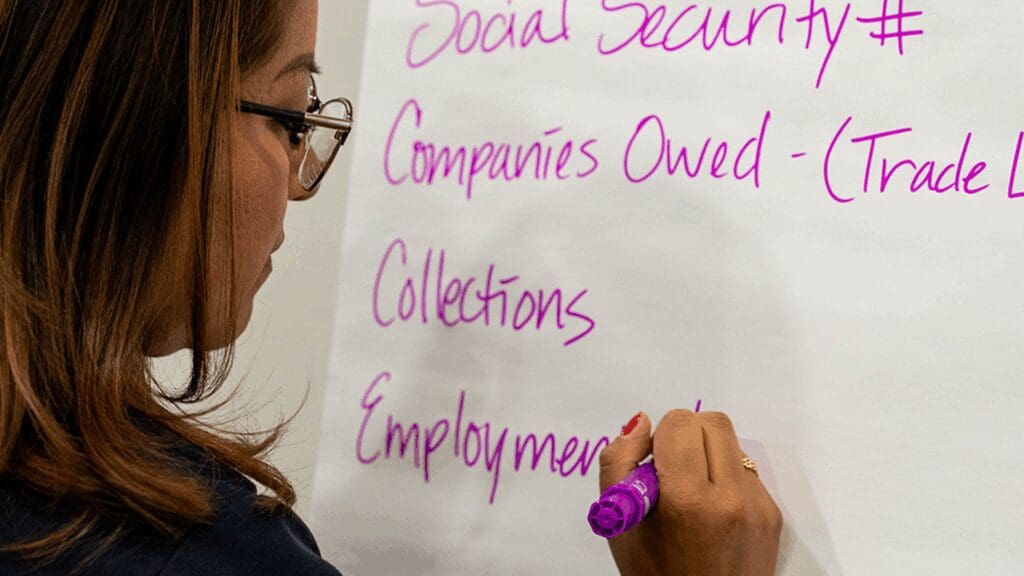

In partnership with Enterprise Bank & Trust and led by local banking experts Uriah Cachora (AVP, Community Development Officer) and Diego Luna (Senior Loan Coordinator), the Aspiring Youth Academy (AYA) delivered a powerful, no-cost learning experience to Arizona teens through its Money Smart Summer Cohort. This 6-week program, held on June 10, June 25, July 9, July 16, July 24, and July 25, combined both virtual instruction and two final in-person sessions hosted at the 20/30 Club of Phoenix. The hands-on experience focused on developing real-world financial skills to help young people build confidence, understand their financial choices, and plan for a prosperous future.

The Journey: From Uncertain to Confident

Before joining the cohort:

- Only 11% felt very confident managing money

- 43% were not very confident, and 14% were not at all confident

After the program:

- 93% now feel very confident in managing money

- The remaining 7% feel somewhat confident—a significant shift in overall financial self-efficacy

✨ 100% of participants said they now feel more confident making smart money decisions.

Teens Are Talking — And So Are Their Families

- 89% of students reported having meaningful financial conversations with family

- The other 11% had at least started sharing what they learned

- 100% of teens said they gained tools they could use in real life

- 100% would recommend the program to a friend

Learning That Sticks

We asked, “What are you walking away with?”

Students said:

💬 “The biggest takeaway is learning how to set SMART goals, manage money, and protect myself from scams. It gave me real control over my future.” – Grade 12

💬 “This taught me how to budget, save, and think ahead. I didn’t learn this in school, but now I feel like I know what I’m doing.” – Grade 11

💬 “It’s a future-building program. Every youth needs to hop on.” – Grade 12

Community, Connection & Support

- 57% made new peer connections

- 100% felt they now know where to go for support about financial questions

- Most preferred the virtual learning model:

- 89% preferred virtual sessions

- 9% liked a combination of in-person and virtual

- 2% preferred fully in-person

Continued Engagement

- 100% want to continue learning about money

- 93% are interested in joining future AYA programs or mentorship

Real-Life Action Steps Teens Are Taking:

We asked what they’re most likely to do next:

- 89% said they’d open a savings account

- 82% want to track their spending

- 75% plan to talk to a parent or guardian about money

- 61% want to start a financial goal

- 59% are thinking ahead to building credit

Teaching Financial Literacy Differently — and It Shows

This cohort was more than a workshop. It was a bridge between learning and action—between knowledge and confidence. Teens walked away not just knowing terms like “budget” and “credit,” but applying them to real-life goals like buying a car, saving for college, and starting businesses.

And they said it best:

“Planning for the future isn’t just something adults do. I learned that even as a teen, I can set financial goals and start working toward them, like saving for college or a car.” – Grade 12

“I learned how to actually budget my money instead of just spending it all. Now I know how to break it into needs, wants, and savings, which makes me feel more in control of my money.” Grade 11

“This program teaches you stuff school doesn’t, like how to handle real money, avoid getting scammed, and save for things you care about. It’s stuff you’ll actually use in real life.” – Grade 11

“Without this program, I’d still be making the same terrible spending decisions I used to make. I’ve told my sister about this and she’s happy for me.” – Grade 12

“I would describe this program to be the best summer event that has happened to me.” – Grade 12

“I would simply say that this program was the best so far in terms of finances for a better tomorrow.” – Grade 12

“The biggest takeaway I’m walking away with from the Money Smart cohort is learning how to set SMART goals for my finances, which helps me create clear and achievable plans. I also gained important skills in managing money, creating and sticking to a budget, and knowing how to report scams or fraudulent activity. These lessons have given me greater confidence and control over my financial future.” – Grade 12

“I would say this program matters because at a young age it is good to start having good practices with money, because having good money practices (and also thinking about money in a good way) can carry on later in life like a habit.” Grade 10

“This program helps with making smart financial decisions in the real world where it matters most.” – Grade 11

“It’s a future-building program. Every youth needs to hop on.” – Grade 12

A Lasting Resource for Teens and Families

We’re proud to announce that the materials used in the program—including handouts, slides, and practical tools—will be available to the public as a digital resource on our website. These tools will live on as a reference library for youth and families navigating their financial futures. Stay tuned for the upcoming fall/winter 2025 cohorts.

👉 Access the tools here: AYA Innovation Hub Financial Literacy Resources (link placeholder)

Thank You to Our Facilitators

We extend heartfelt gratitude to Uriah Cachora and Diego Luna, whose expertise and approachable teaching style empowered every teen who attended. The impact of your guidance lives in every SMART goal written, every budget built, and every conversation sparked around the dinner table.

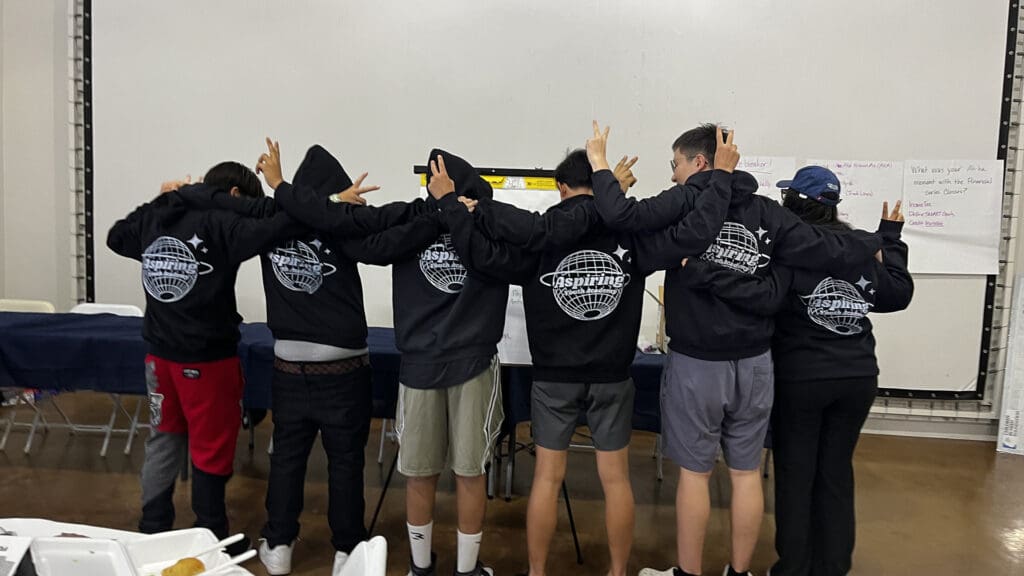

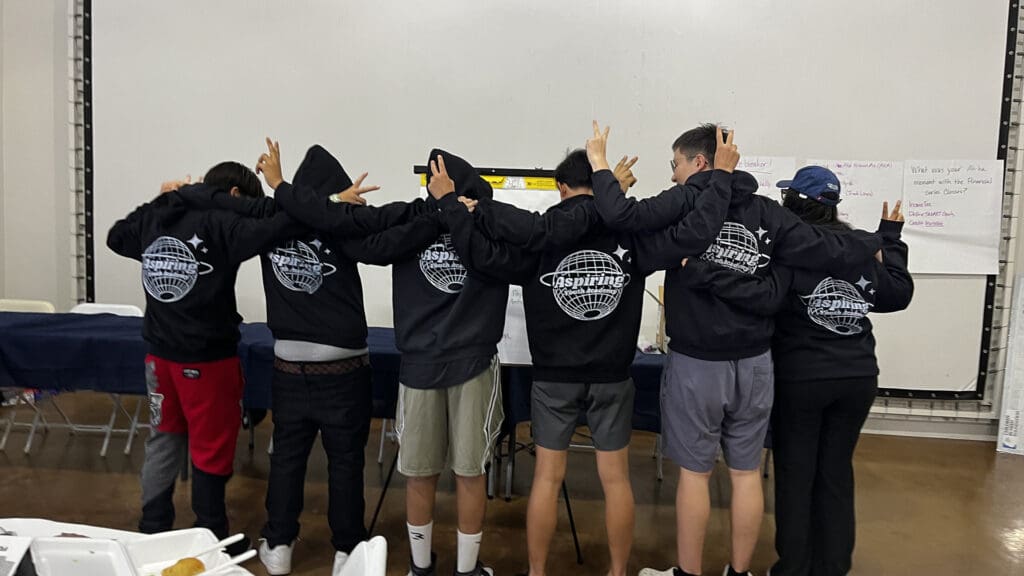

Congratulations to the 2025 Money Smart Cohort and the incredible Aspiring Teen Leaders (ATLs) of Aspiring Youth Academy!

Alayna, Alexis, Alfred, Ali, Antony, Austin, Bryan, Candi, Carl, Caroline, Clara, Clef, Cole, Danny, David, Donald, Drew, Eric Ramon, Ethan, Fred, Harley, Harrison, Ian, Jay, John, Joseph, Julian, Keanu, Mariah, Mary, Mason, Mathew, Matthew Saba, Micah, Paul, Richard, Ronak, Ruford Thomas, Sabastian Philippe, Sam, Shauryaveer, Simeon, Smith, Starz, Steve, Theo, Walter, William, Williams.

Your commitment to learning, growing, and leading the way toward brighter financial futures is inspiring. You’ve taken powerful steps to invest in yourself—and your community. We can’t wait to see what you’ll do next.

Would You Like to Make a Direct Impact?

❤️ Would You Like to Make a Direct Impact?

You can help more teens become Money Smart. Your support allows Aspiring Youth Academy to continue offering this free, high-quality program to youth across Arizona.

🎯 Sponsor a Teen’s Financial Future!

Your support makes a lasting difference.

💡 $100 sponsors one teen through the full 6-week Money Smart program—empowering them with real-world financial skills, mentorship, and hands-on learning.

🎁 $50 provides a Visa Gift Card as a reward for a teen who completes the program and takes action toward building a brighter financial future.

Invest in the next generation of financially confident leaders! Donate today.

📩 Contact us at info@aspiringyouth.org

Let’s keep building a financially prepared generation—one teen at a time.

Related Posts

Aspiring Youth Academy Receives a Grant from the Burton Family Foundation to Support Spring Break Innovation Camp

Scottsdale, AZ — Aspiring Youth Academy (AYA) is proud to announce they received a grant…

Aspiring Youth Academy Celebrates Extraordinary Teen Entrepreneurs at the 2025 “Aspire to Pitch!” Competition

The five teen finalists of the 2025 “Aspire to Pitch!” Competition celebrate their achievements at…

Aspiring Youth Academy Partners with ASU’s J. Orin Edson Entrepreneurship + Innovation Institute to Empower Teens in our Community

FOR IMMEDIATE RELEASE – September 25, 2024, Phoenix, AZ – Aspiring Youth Academy (AYA), a…